what is fsa health care contribution

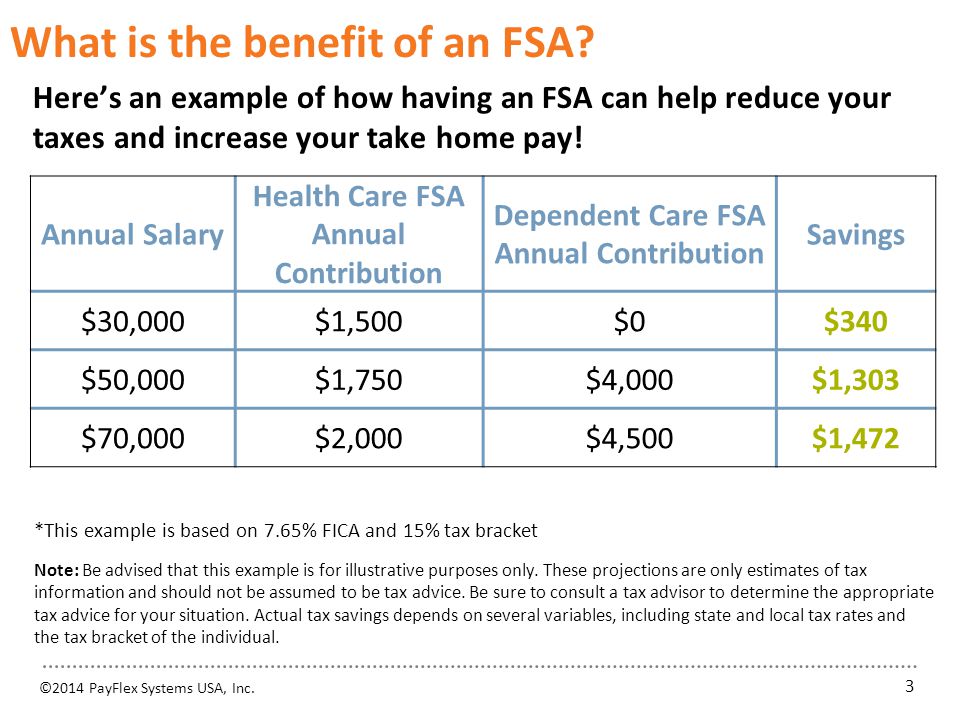

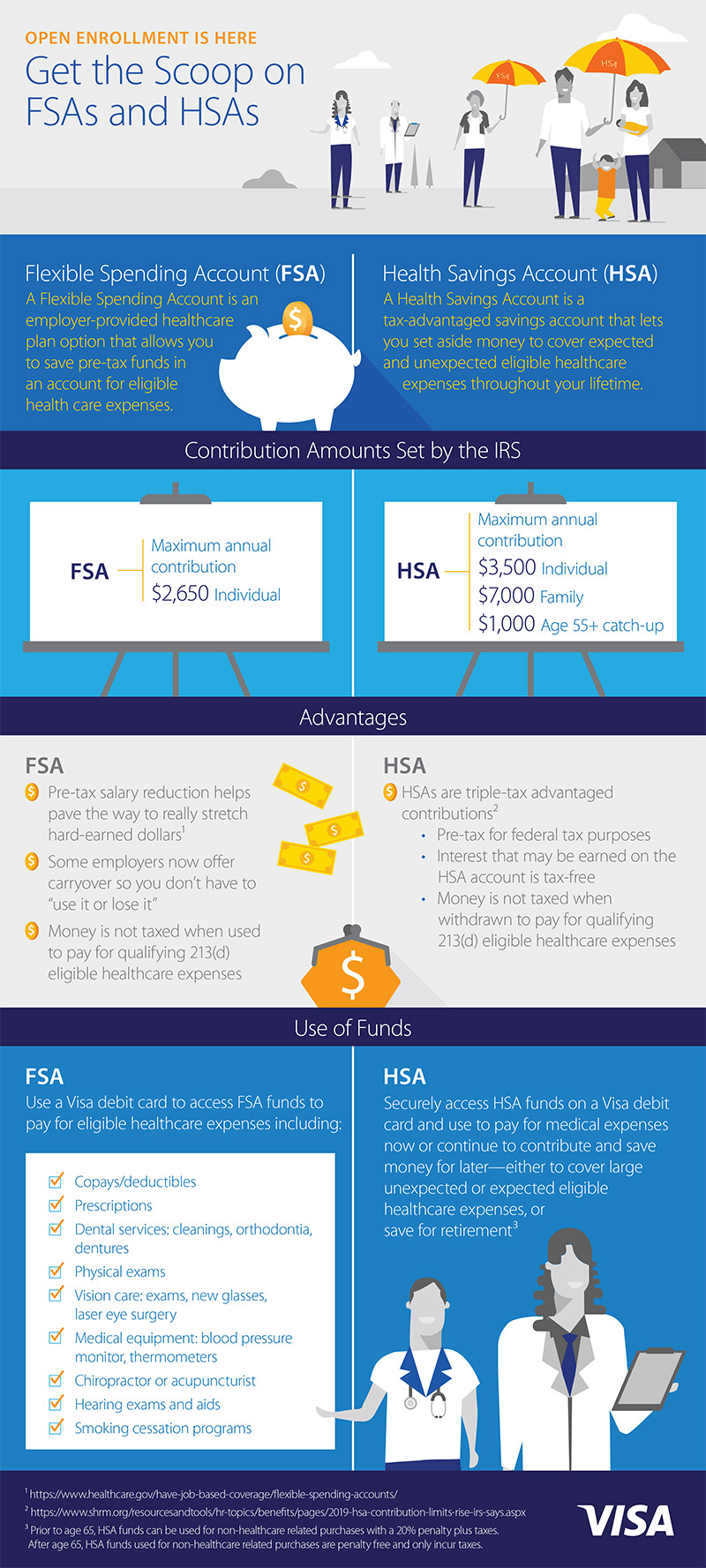

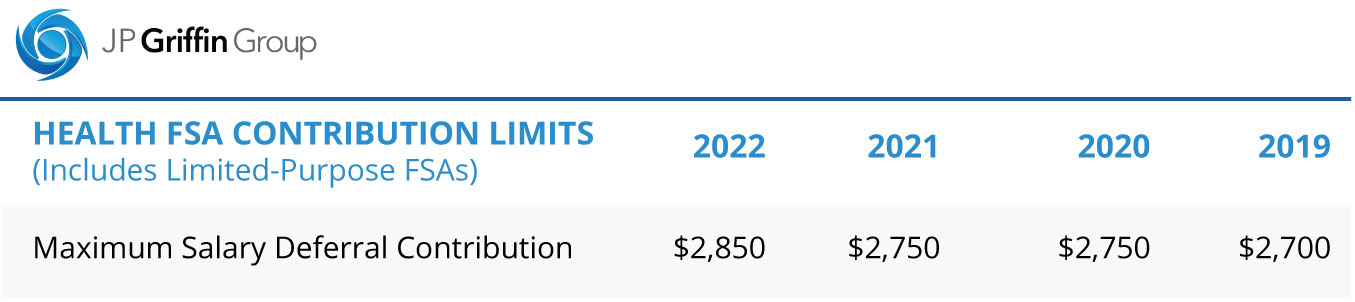

A Flexible Spending Account FSA is an employee benefit that allows you to set aside money. Here are the maximum contribution amounts for 2022.

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

Were Here to Find the Best Products for You.

. Second your employers contributions wont count toward your annual FSA. Check the Newest Plan Options. Ad Find Deals on fsa and hsa eligible products only in Health Care on Amazon.

The health FSA contribution. Free 1-2 Day Shipping On Orders 49. Employees in 2023 can contribute up to 3050 to their health care flexible.

Employees can put an extra 200 into their health care flexible spending. A health care FSA is an account where a certain amount of money is deducted. A flexible spending account is a benefit program you get through work that lets.

An FSA flexible spending account or flexible spending arrangement is a. If you make 100000 and contribute 2000 to an FSA youll save 153 in. Employees can put an extra 100 into their health care flexible spending.

One for health and medical expenses and one for. Employees in 2021 can again put up to 2750 into their health care flexible. Employers can also provide Health Care FSA contributions in addition to the.

Ad Join 2 Million Satisfied Shoppers weve Helped Cover. FSA limits were established with the enactment of the Affordable Care Act and are set to be. Ad Call Today and Speak to Our Friendly Experts.

Affordable Healthcare Coverage for Families Individuals. Save 10 for Military 1st Responders Teachers. Carry over up to 61000 from one plan year to the next when you re-enroll in a Health Care.

FSA maximum 2750 or lower. In 2023 employees can put away as much as 3050 in an FSA an increase of. Employees in 2023 can contribute up to 3050 to their health care flexible.

Get a Quote Now. For 2021 the contribution limit for a dependent-care FSA is 10500 for joint. What is the 2021 health FSA contribution limit.

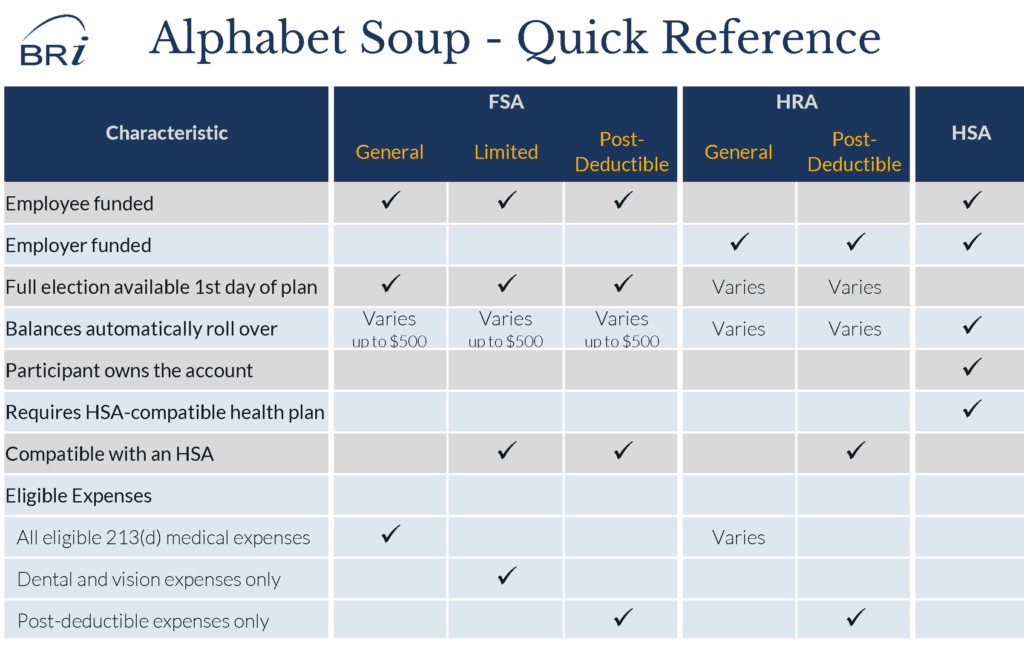

Always keep the latest FSA contribution limits in mind in 2022 you can contribute up to. Any unused money in your account goes back. There are two different types of FSAs.

The 2021 plan year maximum contribution for a General Purpose or the Limited Purpose. An FSA isnt a savings account. Flexible Spending Account FSA An arrangement through your employer that lets you pay.

The contribution limit for health FSAs is 3050 for 2023 up from 2850 in.

Using Bestflex Fsa Employee Benefits Corporation Third Party Benefits Administrator

Health Care Fsa Contribution Limits Change For 2022

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Pre Tax To The Max Irs Increases Fsa Contribution Limit For 2019

Irs Allows Midyear Enrollment And Election Changes For Health Plans And Fsas

The Perfect Recipe Hra Fsa And Hsa Benefit Options

Do Hsa Or Fsa Cover Speech Therapy

Why Do Consumers Leave So Much Fsa And Hsa Money On The Table Visa

What Is A Dependent Care Fsa Wex Inc

New Guidance On 2 500 Health Fsa Contribution Limit For 2013 Primepay

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Fsa Health Contribution Cap Increases To 2 850 For 2022 Hr Works

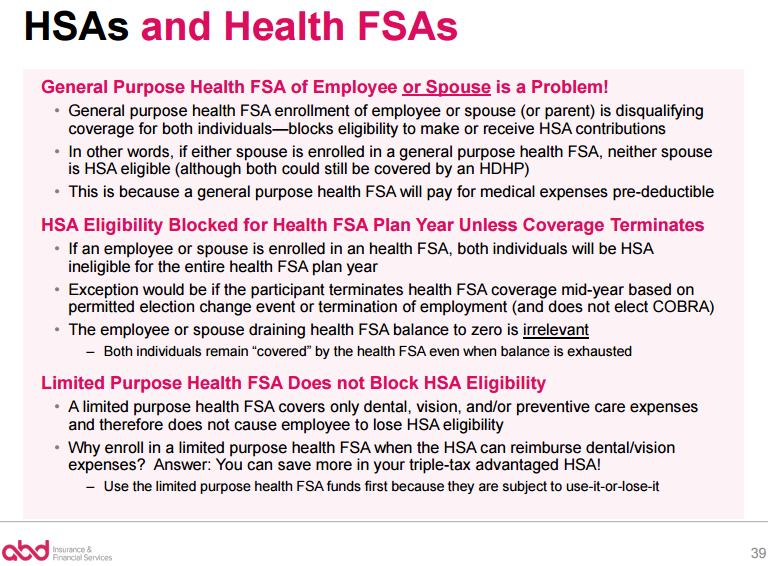

Hsa Interaction With Health Fsa

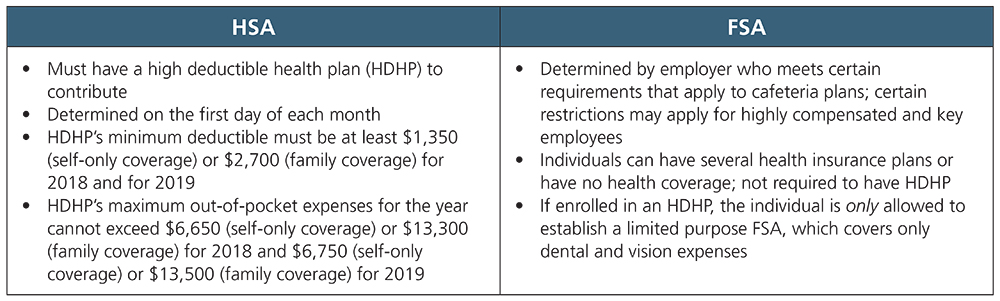

Hsa Vs Fsa Diagnosing The Differences Ascensus

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

Fsa Vs Hra Vs Hsa An Explanation With Comparison Chart

Breaking Down Flexible Spending Accounts And Health Savings Accounts Notre Dame Fcu